Medicare

Medicare Specialist - LTC Consultant - Annuity Representative - Financial Guide“You only live once – so make your life count and significantly impact as many as possible”

Original Medicare is very difficult to ‘navigate’ alone. We seek to make it a journey that is educational, thorough and gives each person ‘peace of mind’ on when to begin and ensure each person knows;

1. What the costs are,

2. What the benefits are and,

3. How to fill the gaps.

Within the Insurance and Financial World, we believe that our services and products serve people’s greater goals and aspirations.

Any questions based on Original Medicare are important and vital to have clarity and understanding. We seek to bring that educational touch so that you can have an accurate assessment and ease choice to make.

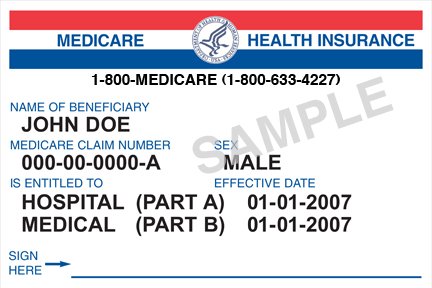

Original Medicare

Original Medicare is a federal health insurance program that covers a range of healthcare services for individuals aged 65 and older, as well as some younger people with disabilities. It consists of two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). Below is a breakdown of the essentials and costs:

1. Part A (Hospital Insurance)

Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

Essentials Covered by Part A:

- Inpatient hospital care: Includes semi-private rooms, meals, general nursing, and other hospital services and supplies.

- Skilled nursing facility care: After a hospital stay, for rehabilitation or medically necessary care.

- Hospice care: For terminally ill patients.

- Home health care: Some home care services after hospitalization.

Costs for Part A:

- Premium: Most people do not pay a premium for Part A because they (or their spouse) paid Medicare taxes while working. However, if you or your spouse didn’t pay Medicare taxes for at least 10 years, you may have to pay a premium. For 2024, the Part A premium can range from $278 to $506 per month depending on how long you or your spouse worked and paid Medicare taxes.

- Deductible and Coinsurance:

- Deductible (2024): $1,632 for each benefit period (the period of time you are admitted to the hospital).

- Coinsurance: For hospital stays, the coinsurance cost varies:

- Days 1–60: $0 coinsurance.

- Days 61–90: $404 per day.

- Days 91 and beyond: $808 per day (after exhausting 60 lifetime reserve days).

2. Part B (Medical Insurance)

Part B covers outpatient care, preventive services, and some other healthcare services like doctor visits, lab tests, outpatient surgeries, and durable medical equipment.

Essentials Covered by Part B:

- Doctor visits: Physician services for both inpatient and outpatient care.

- Preventive services: Such as flu shots, screenings for cancer, diabetes management, etc.

- Outpatient care: Includes outpatient surgery, diagnostic tests, and rehabilitation.

- Durable medical equipment (DME): Equipment like wheelchairs, oxygen, and walkers.

Costs for Part B:

- Premium (2025: The standard premium for Part B (making less than $106K (single) is $185.00 per month for 2025. Higher-income individuals may pay more based on their income (Income-Related Monthly Adjustment Amount or IRMAA).

- Deductible: $257 per year for 2025

- Coinsurance: After the deductible is met, you typically pay 20% of the Medicare-approved amount for most services.

Additional Costs for Original Medicare:

- Out-of-Pocket Costs: Original Medicare doesn’t cover everything. For instance, it doesn’t cover prescription drugs, most dental care, vision, or hearing aids. You will likely need additional coverage for these, such as:

- Medicare Part D (Prescription Drug Plan)

- Medicare Supplement Insurance (Medigap)

- Medicare Part D (Prescription Drug Coverage): Costs for Part D vary depending on the plan you choose. The premium is around $0–$85 per month, but this can vary significantly based on the plan and your location.

Medicare Supplement Insurance (Medigap)

Some people choose to purchase a Medigap plan (Medicare Supplement) to cover the gaps in Original Medicare (e.g., coinsurance, copayments, and deductibles). Costs for Medigap plans vary widely based on the plan letter you choose, your location, and other factors, but on average, Medigap premiums range from $100 to $300+ per month.

Summary of Costs (2025) for Original Medicare:

- Part A: No premium if you’ve worked enough, but deductibles and coinsurance can apply.

- Part B: Standard premium is $185.00 per month, with a $257 annual deductible and 20% coinsurance for most services.

- Part D (optional): Prescription drug coverage costs between $0 to $80 per month on average.

- Medigap (optional): Supplement insurance premiums can range from $100 to $300+ per month.

These costs can vary depending on your specific circumstances, such as income and healthcare needs.

The Value of Original Medicare and Private Insurance to “fill the gaps”!

Original Medicare VALUE - Government coverage and limitations

Original Medicare (Part A and Part B) offers significant value for people aged 65 and older, providing essential health coverage and access to a wide range of healthcare services. The value of Original Medicare can be broken down in terms of its benefits, cost savings, and coverage features that are particularly beneficial to seniors:

Key Benefits of Original Medicare for Seniors

1. Comprehensive Coverage:

Original Medicare offers coverage for many critical healthcare needs, which can provide peace of mind and financial protection for seniors. It covers:

- Hospital stays (inpatient care), including semi-private rooms, meals, and nursing care (Part A).

- Doctor visits and outpatient care, such as lab tests, physical therapy, and some preventive services (Part B).

- Preventive services, like cancer screenings, vaccines (e.g., flu shots), and annual wellness visits, which help to detect and manage health conditions early, often at no additional cost beyond the Part B premium.

2. Nationwide Access:

Original Medicare offers nationwide coverage, meaning that seniors can see any doctor or specialist who accepts Medicare and receive care in almost any hospital or healthcare facility across the United States. This flexibility is especially valuable for those who may travel frequently or live in different areas over time.

3. No Network Restrictions:

Unlike many private health insurance plans, Original Medicare doesn’t require you to choose a primary care physician (PCP) or get referrals to see specialists. This can make it easier for seniors to get the care they need without having to navigate complex insurance networks.

4. Coverage for Major Healthcare Needs:

- Inpatient care: Seniors facing hospital stays due to illness, injury, or surgery can rely on Part A to help cover a significant portion of the costs. This can protect against potentially devastating out-of-pocket expenses from long hospital stays.

- Outpatient care: Many medical conditions require outpatient care, and Part B covers many physician visits, outpatient surgeries, diagnostic tests, and rehabilitation services, which are crucial for seniors with chronic conditions.

5. Preventive and Wellness Services:

Original Medicare provides access to important preventive services at no cost or a low cost (as long as the services are provided by Medicare-approved providers), which are essential for seniors to maintain their health:

- Cancer screenings (e.g., mammograms, colonoscopies).

- Vaccines (e.g., flu shots, pneumonia vaccines).

- Wellness visits that help manage chronic conditions, monitor health status, and prevent further complications.

Cost Effectiveness of Original Medicare

6. No Network or Plan Selection Hassles:

Seniors don’t need to worry about selecting a network or picking specific doctors or healthcare facilities. As long as the provider accepts Medicare, seniors can receive care. This simplifies healthcare decision-making and minimizes administrative burdens.

7. Lower Premiums (for Most People):

- Part A has no premium for most people, provided they or their spouse worked and paid Medicare taxes for at least 10 years. This can save seniors from high monthly insurance premiums.

- Part B requires a premium, but for many seniors, this is still relatively affordable ($185.00 for 2025). Considering the coverage it offers, especially for outpatient care, this is often much more cost-effective than private insurance options.

8. Protection Against High Healthcare Costs:

While there are costs (e.g., deductibles and coinsurance), Original Medicare helps protect seniors from catastrophic healthcare costs. For example, seniors who are hospitalized for a significant period may face high bills, but Medicare’s coverage ensures they won’t be stuck with the full financial burden.

9. Optional Extra Coverage (Part D and Medigap):

- Part D (Prescription Drug Coverage): While Original Medicare doesn’t cover prescription medications, seniors can add a Part D plan to cover prescription drugs, which can lower out-of-pocket medication costs.

- Medigap (Supplemental Insurance): Seniors can also purchase Medigap insurance to cover gaps in coverage (e.g., coinsurance and deductibles), providing more comprehensive financial protection and reducing out-of-pocket expenses.

Challenges to Consider

Despite its many benefits, Original Medicare does have limitations:

- No prescription drug coverage: Without enrolling in Part D, seniors may face high costs for medications.

- No coverage for some services: For example, dental care, vision, hearing aids, and long-term care are not covered under Original Medicare. Seniors may need separate plans to cover these needs.

- Deductibles and coinsurance: There are still significant out-of-pocket costs for hospital stays and outpatient services, which could add up if healthcare needs are extensive.

Overall Value of Original Medicare for Seniors

For seniors aged 65 and older, Original Medicare provides valuable healthcare coverage that is broad, flexible, and cost-effective, especially when compared to many private insurance options. It offers a solid foundation for healthcare needs, with the potential to add supplemental coverage (Part D, Medigap) for a more comprehensive plan.

While it may not cover everything and can come with out-of-pocket costs, the combination of no network restrictions, comprehensive hospital and outpatient care, preventive services, and affordability (for most beneficiaries) makes Original Medicare a critical resource for older adults looking to manage their health and healthcare costs.

Jeorge Holmes

Present Responsibilities

A Licensed Broker Agent with “Key Retirement Solutions” under the National Organizations; “Integrity Marketing Group” and “American Senior Benefits” allows him and his team to be licensed with many (up to 175) top carriers that provide products and services for ‘wealth, health, and ‘life solutions’.

With the top private carriers in our arsenal, we can ‘SHOP for our CLIENTS’ and offer the most reliable and reasonable coverage available in the industry, across all 50 states.

Upline For Licensing, Compliance, Integrity, Education

Integrity Marketing Group

American Senior Benefits

https://americanseniorbenefits.com

Key Retirement Solutions

YoloCoverage.com

Call TODAY and connect with a specialist!